Get unbiased information & curated options for investment

Invest in Surat

, Any BudgetPreleased Shops & Offices

Rentals from day1

POPULAR

New Launch Deals

High appreciation

Invest in Land

Get long term gains

LONG TERM

Shops in High Footfall Areas

Attractive rentals

Invest with trusted builders

Low risk

Preleased Shops & Offices in Mumbai

Rentals from day1

POPULAR

New Launch Deals in Mumbai

High appreciation

New Launch Deals in Ahmedabad

High appreciation

Shops & Offices in Mumbai

Attractive rentals

New to investment? Start with basics

Know what is right for you from experts

Investor’s Guide 2023

Get high returns in long run

Projects with promising gains

ROI: Returns On Investment

ROI is a measurement of how much money, or profit, you have earned on an investment as a percentage of its total cost.

Build secondary income

With great monthly rentals

Katargam

₹ 7 Crores

Shop

Bhestan

₹ 19.9 Lacs

Shop

Yogi Chowk

₹ 1.35 Crores

Office Space

in Bank

Ring Road

₹ 4.25 Crores

Shop

LP Savani

₹ 40 Lacs

Office Space

in VESU

Vesu

₹ 42 Lacs

Shop

in VESU

Vesu

₹ 1.2 Crores

Shop

in majura gate

Majura Gate

₹ 51 Lacs

Office Space

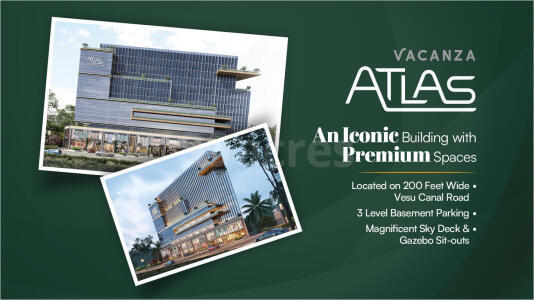

in VESU ROAD

Vesu

₹ 46.92 Lacs

Shop

in Happy Goldmines Shop...

Vesu

₹ 94 Lacs

How Real Estate helps you achieve your financial goals

- Portfolio

diversifcation - Generate

passive income - Get tax

advantages - Ideal for Long

Term Investment

Discover Top Cities

Popular among Investors in Real Estate

Guides & Articles

Related to Real Estate Investment