Are you looking for ways to earn healthy returns from your real estate investment? If so, it is imperative to stay abreast of the latest realty trends in the market and constantly revise your strategies as you go to maintain profitability and achieve financial goals. Here are some simple ways to increase profits from your invested properties.

Tips to maximise returns from real estate investments

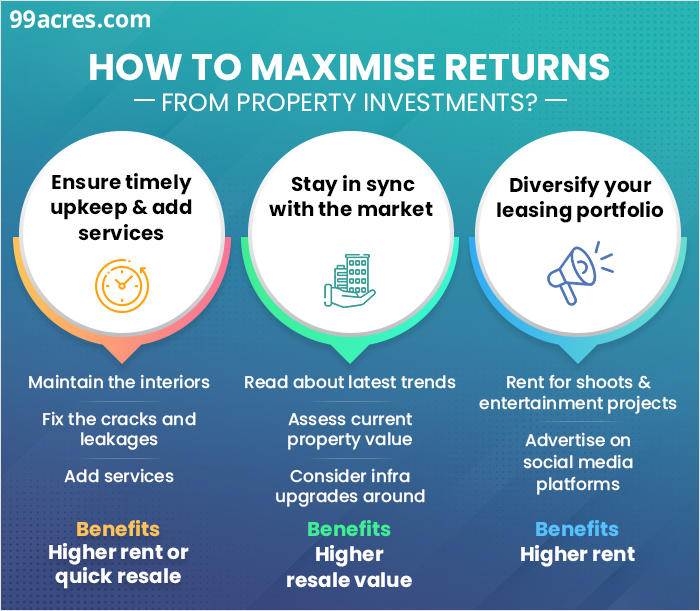

Stay on top of maintenance

One of the best ways to maximise returns from an invested property is by renting it out. However, rental properties require attention with respect to maintenance and tenants to stay ahead of others and reap more fiscal benefits. For instance, if you have rented out your property and want to earn higher rentals, analyse whether it is time to let go of your old tenant and hire new one. Experts believe letting the same tenants stay for long may make it difficult for landlords to increase the yearly rent amount beyond a percentage agreed upon in the rent agreement. However, ensure that you advertise your property well to get other tenants onboard soon to avoid vacancy periods.

You can also increase the rental value of the property by making some repairs to the asset, doing the interiors, fixing the leakage or adding some services that make the stay comfortable for the tenant. For instance, installing a wall-size glass door in the living room balcony that allows more ventilation and natural light or adding a chimney in the kitchen would do wonders. While it may be heavy on your pocket one time, it will help you earn good returns throughout the year.

Monitor the market changes

Mere investment in real estate would not hold if you intent to reap good returns. It is indispensable to stay active and keeps tabs on market dynamics. Comprehend the changes in the real estate market from time to time and analyse how you can modify your strategies to earn high returns. For instance, if you plan to maximise your capital returns by reselling the asset, the best way to do so is by knowing the current rate of your property. If the market rate of your property is lower than other similar assets in the area, it’s time to up your renovation game. Undertake some necessary changes that would help improve the resale price of the property like painting the house and fixing the roof or cracks, among others.

In case of commercial asset, you can offer some rental schemes to tenants or undertake some redesigning of the interiors to suit their evolved needs, like a brainstorming area, a relaxed coffee space or enhanced ventilation.

Experts also suggest holding the property until the prices rise. Any mega infrastructure development, if proposed in your area, may also help boost the property prices. Hence, read the local realty trends and gauge how the market is expected to unfold before putting your property on sale to maximise returns. You can also seek assistance on the matter from a seasoned realty broker in your area.

Diversify your leasing portfolio

Apart from renting your property to tenants, you can also let it out for shoots and entertainment projects. In the world of digitisation, youngsters today are heavily inclined towards creating video content and often look for places where they can shoot their projects. Renting a property for such projects would help you earn way more than renting it to one tenant. Also, such projects are for shorter duration and you can charge a different amount for different projects basis the number of hours or days your property is used. However, make sure that the property is well-maintained, and has legal compliances if any required for such activities. You have to also make constant efforts to rope in new projects or create a team of trusted brokers, who can help you with it. Further, advertising your property on various social media platforms can also help you bag many projects.

Consider the role of inflation in property values

When considering appreciation, you have to factor in the economic impact of inflation. An annual inflation rate of 10 percent means that your rupee can only buy about 90 percent of the same goods, and that includes property too. If a piece of land was about Rs 1,00,000 in 2008 and it remained dormant and undeveloped for a decade, its worth would still be many times more in an inflationary market condition.

Thus, inflation alone can lead to appreciation in real estate, but it is a bit of a statesman victory. While you may get 4-5 times your money due to inflation, many other goods cost five times as much too.

Income-producing property is one of the lucrative investment options. However, you need to analyse the market condition regularly. Knowing the price trends will help you decide when to sell off the asset to reap more returns.

See our latest webstory on 4 tips to maximise returns from real estate investments!