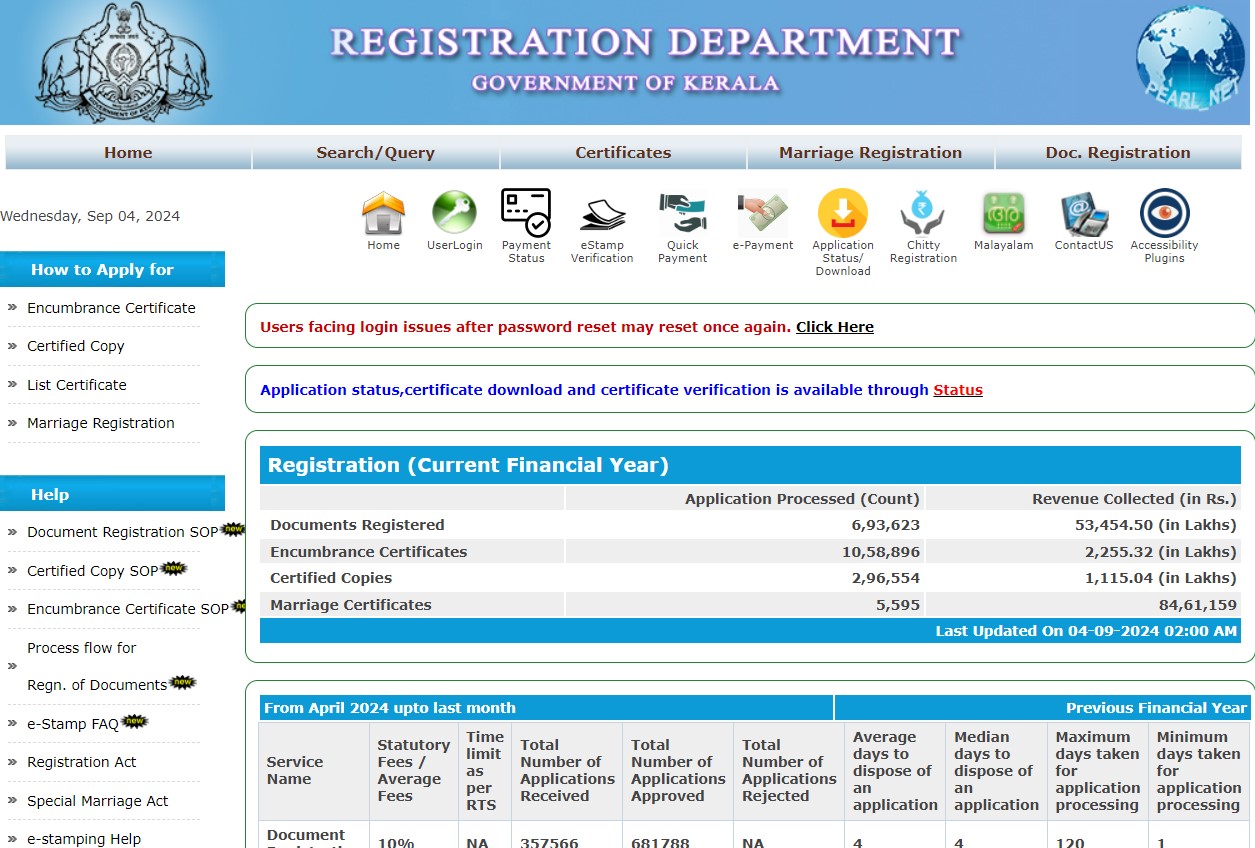

The Kerala Registration Department plays a crucial role in regulating and overseeing property transactions within the State. With the advent of technology, the department has also embraced online services, making it easier for individuals to access and complete property-related tasks efficiently.

If you are a resident of Kerala and looking for ways to obtain encumbrance certificates, register your property or pay the stamp duty, among other facilities, then the Kerala IGRS website is your key. Continue reading to know about accessing online services on the Kerala Registration Department portal.

What are the services provided by the Kerala Registration Department portal?

Services offered by the Kerala Registration Department on its portal Pearl include:

- Property document registration - The portal offers services to register property documents online.

- Apply for EC – Users can apply for property encumbrance certificates online for property sale or purchase.

- Get a certified copy of registration documents – The portal allows users to apply for a certified copy of documents available through the Registration Department

- Details on stamp duty and fees – Users can review the latest stamp duty and fees in both English and Malayalam language

- Scribe's/Document writer's fee – View scribe and document writing fees under Kerala Document Writers’ Licence Rule 1960.

- Society registration – Group housing society associations can register their society online.

How to apply for an EC in Kerala?

EC is a crucial document confirming the free title and current ownership status of the property in discussion. It is significant for property transactions and applying for loans. In Kerala, the EC can be applied online and offline, requiring physical visits and follow-ups to the nearest civic department offices.

Documents required to apply for an EC online in Kerala

Even though the process does not require any document at the time of applying for an encumbrance certificate in Kerala. However, you must keep some reference documents handy if the department requests. These documents include:

- Previous registration documents

- Property tax receipts

Steps to apply for an EC online

Here is a complete step-wise guide to apply for EC in Kerala online:

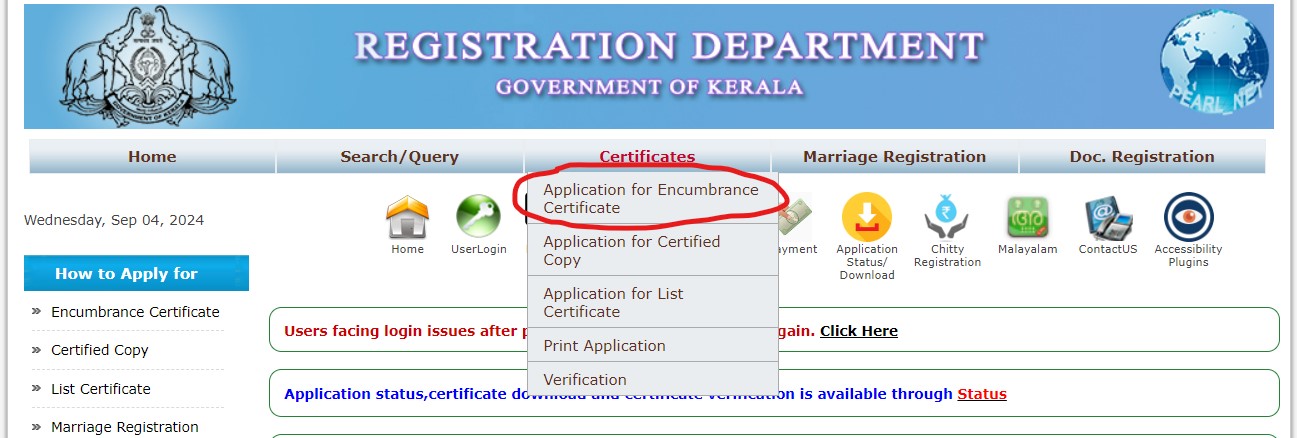

Step 1: Visit the official IGRS website of the Kerala Registration Department

Step 2: From the top menu, go to the "Certificates" and select "Application for Encumbrance Certificate" option

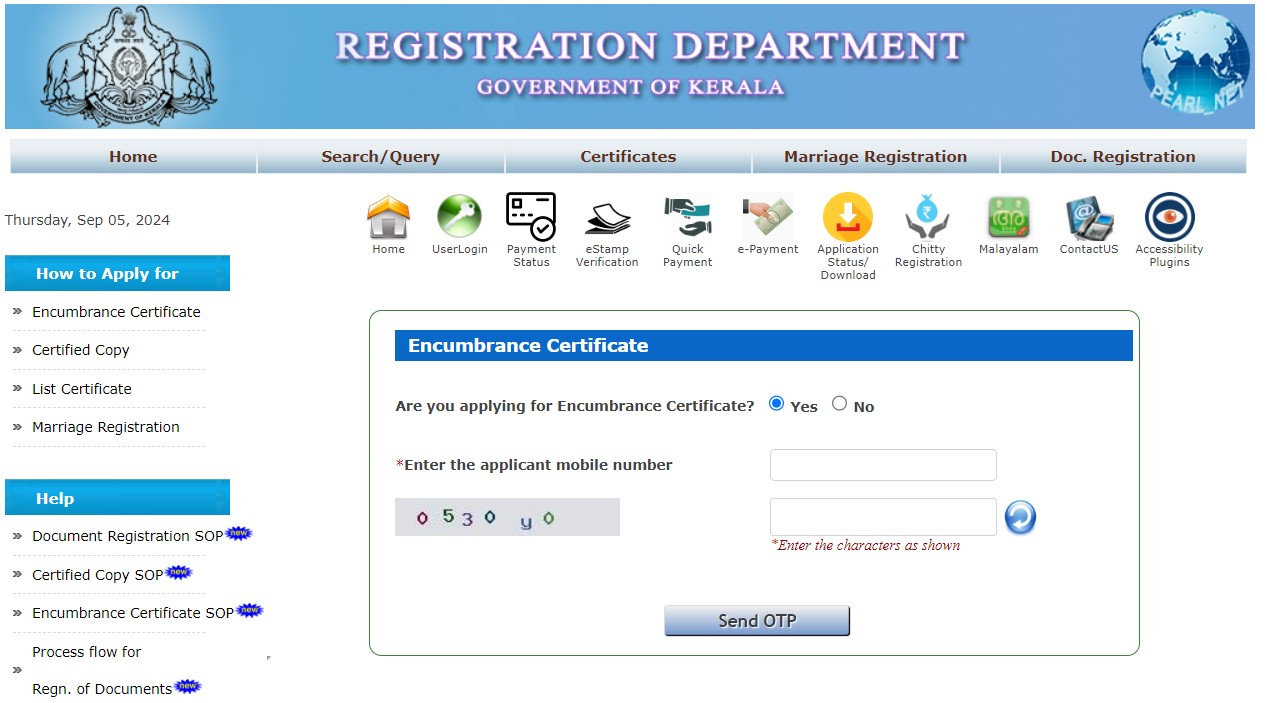

Step 3: The page will ask you to verify whether you are applying for an Encumbrance Certificate. Select "Yes" and fill in the captcha and contact details. Click Send OTP to get an OTP on the provided number. Enter the pin and click Proceed to advance to the next step.

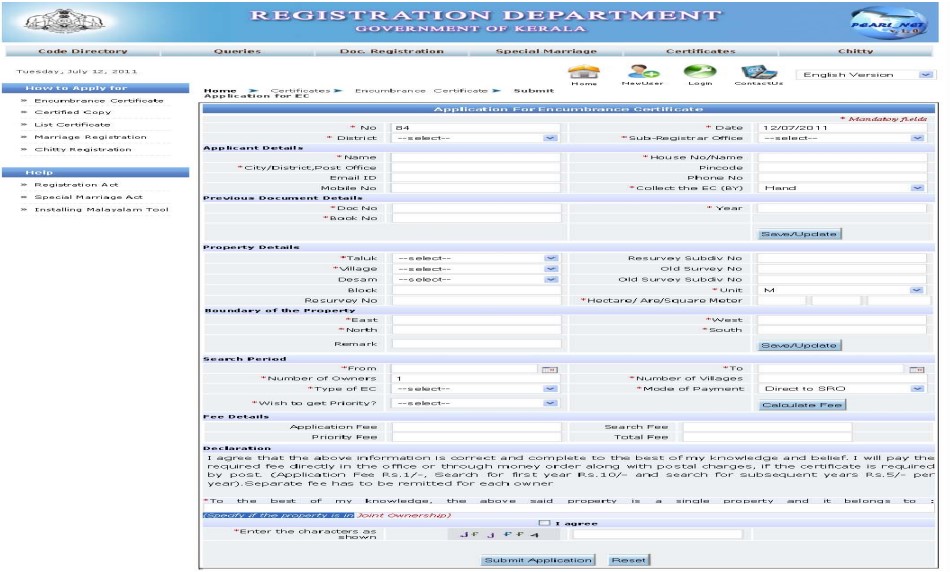

Step 4: On this page, you will be asked to fill in the details of the applicant and property in discussion. Key all the details and proceed ahead to make the payment.

Step 5: Once the payment is made, submit your request, and the application for an Encumbrance Certificate is completed.

Steps to verify EC in Kerala

To verify EC in Kerala, you should know the year the document was requested and the transaction ID. Once you have both details, follow these steps:

Visit the official Kerala Registration Department website

Select the Verification option from the Certificates dropdown menu

In the next window, you will be asked to enter the year, transaction ID details and captcha code

After entering the required details, click the search button to find the document.

Guidelines for filling up the EC form

While applying for EC on the Kerala IGRS website, it is crucial to know the following details to avoid any hassle in the future:

- You must cross-check all the details filled in when applying for an EC online. The department doesn't take any responsibility for incomplete or incorrect information.

- If you require the EC in English, select English in the "Need Certificate" field of the application form. Otherwise, by default, the EC by the Kerala Registration Department is generated in Malayalam.

- You can opt to generate an EC on priority. For this, while applying for an EC in Kerala, you need to select the option "Wish to Get Priority" in the form. However, it is crucial to note that this facility requires paying an additional fee.

Once your certificate is generated, you will receive an SMS notification stating that your certificate is ready to download.

How to register a property online on the Kerala Registration Department portal?

Property registration is important for any buyer or investor to reduce the chances of any conflict or dispute over the property. The process of registering a property requires several steps. Before we delve into the property registration process in Kerala, let’s first understand the documents required.

Documents required for property registration in Kerala

Although the documents required for property registration may vary from case to case, there are some critical documents you should keep handy:

- Identity proof of buyer, seller and witnesses

- Copy of deed issued by the registration department

- Application

- Original or copies of previous deeds

- Property valuation certification (under Section 28C or 28B of the Stamp Act)

- Mutation application proof

- Form 58

- No-objection certificate

Steps to register a property in Kerala

New users looking to register their property in Kerala online can use these steps:

Step 1: Visit https://pearl.registration.kerala.gov.in/

Step 2: Click the User Login icon below the navigation bar on the website. In the next window, select the ‘Create Login’ option at the bottom of the form.

Step 3: You will find a new registration form in the new window. Here, you will be asked to submit personal details. You can register on the domain and create your login credentials by submitting these details.

Step 4: Go back to the Home Page using the navigation menu at the top and select User Login again. In the next window, fill in your user ID, password and captcha code to log in.

Step 5: On the following page, scroll down for the document registration option. Select the option, and you will be redirected to another form where you must submit your personal and property details.

Step 6: Once all the fields are filled out and the form is submitted, you will be transferred to the search for an available token page . The page will help you get an appointment, also known as a token. Here, you can select the district, sub-registrar's office, and taluka and present the date as convenient. Select the available slot that fits your preferred date and time.

Step 7: Once you have submitted the selected transaction type, you will move to Presentation Details Page. The page will ask you to submit details regarding the presenter and documents. Once all details are filled in, click Next to continue.

Step 8: You will be asked to submit property details in the following form. These details will include property in hand, property for transaction, fair value, and boundary details.

Step 9: You must provide executant (applicant) details in the following form. These details will include information on the executant's contact details. Once all details are filled in, select the skip/next button to continue.

Step 10: On the next page, you will be asked to enter details about the building. Fill in the mandatory fields and select the Next button.

Step 11: This page will ask you to add claimant details, property details and claimant property link.

Step 12: This step will require adding details about the enclosures.

Step 13: The following form will contain a request for details about the witnesses.

Step 14: This page will ask you to enter Stamp Paper details. Once you submit all this information, you will be redirected to another window for extra notes. You may skip this step if required.

Step 15: Once all details are submitted, you can review them and click "Accept and Submit to SR".

Stamp duty and registration charges in Kerala

To register a property in Kerala, the buyer must pay stamp duty and registration charges levied by the state government. These are the stamp duty and registration charges in Kerala:

| Ownership type | Stamp duty | Registration charges |

|---|---|---|

| Male | Eight percent | Two percent |

| Female | Eight percent | Two percent |

| Male + Female (Joint Ownership) | Eight percent | Two percent |

| Male + Male (Joint Ownership) | Eight percent | Two percent |

| Female + Female (Joint Ownership) | Eight percent | Two percent |

Disclaimer: The information mentioned above is subject to change by the government of Kerala. Check with the local authority before proceeding with the transaction.

Steps to pay stamp duty online in Kerala

Here is a step-by-step guide to paying stamp duty and registration charges in Kerala online:

Step 1: Once you have completed the registration process on the portal, you will be asked to review all the details provided. If the details you entered are correct, click the "Accept/Continue" button at the bottom.

Step 2: You will be redirected to the payment page, where you can select your preferred payment mode for online payment. Here, you can review the levied stamp duty charges by the government.

Step 3: Proceed to the payment page and complete the transaction using your preferred method.

Also read: How to check land records in Kerala online?

Moreover, the Kerala IGRS portal differs from e-district portals in terms of their services. The e-District Kerala provides all the government services based on the Common Service Centres model in one place. Meanwhile, Kerala IGRS provides revenue-based services such as stamp duty, certification, and registration. In a nutshell, with the help of online services, individuals can save time and effort while ensuring the legal validity of their property transactions.

See our latest webstory on Encumbrance Certificate in Kerala: Guide