To understand how rental income is taxed in India, a property owner has to first understand the parameters considered by the Income Tax Act of 1961 during the calculation. The total taxable income is derived based on the property's gross annual value or the total rental income. Here is a detailed overview of the income types, calculation process and the latest updates on rental income, as announced in the last Union Budget 2024-25.

What are the different types of income?

For the purpose of easy tax computation, the Income Tax Act has divided the income received by an individual into five different heads. They are as follows:

- Income from salary

- Income from house property

- Income from profits and gains of a business or profession

- Income from capital gains

- Income from other sources

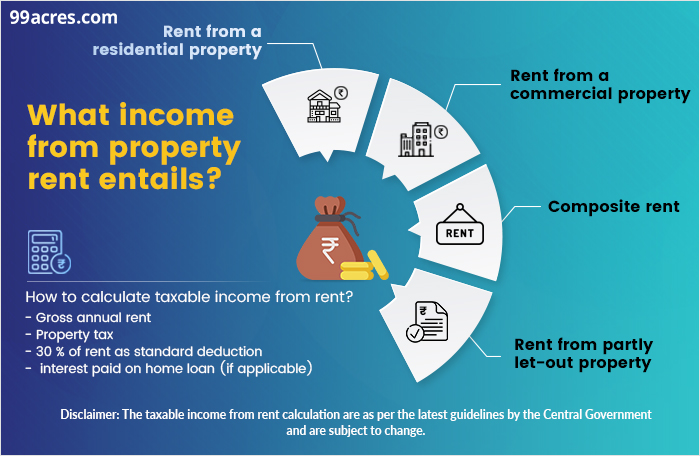

Generally, the amount received from renting out residential properties is classified under 'income from house property'. The tax on rental income is determined after deducting municipal taxes, standard deductions, and interest paid towards an ongoing home loan. Let the section below elaborate on the definition, taxation, and calculation details further.

What comes under income from house property?

It is important to note that not all residential rentals can be filed under 'income from house property'. Here's a look at the different sources that can and cannot be taxed under this section:

| What's Taxed Under Income from House Property | What's Not Taxed Under Income from House Property |

|---|---|

| Rental income from house property- Rental income from a property, whether an apartment, a building, or land, is taxed under the head 'Income from House Property'. | Rental income from sub-letting a property- The rental income received by a tenant from sub-letting a property cannot be taxed under the head 'Income from House Property'. |

| Rental income from composite rent- Composite rent refers to the letting out of a building along with the assets in it. Example- letting out gadgets like washing machine, fridge, tv, etc, along with the house/room. In this case, the rent received for the house will be taxed under the 'Income from House Property' and rent for the assets will be taxed under Income from Other Sources or Profits and Gains of Business and Profession. | Rental income in case the assets are a part of the property- If the letting out of the building and letting out of other assets are inseparable, such as renting out an equipped theatre, then the entire rent will be taxed under 'Income from Other Sources'. |

| Rental income from a partially self- occupied property-Let's say, only a part of the house is occupied by the owner, while the remaining parts are rented out to others. In this case, all the parts of the property will be treated as independent units, and only the income from the let-out units will be taxed as income from House Property. |

|

| Rental income from a partially self- occupied property-Let's say, only a part of the house is occupied by the owner, while the remaining parts are rented out to others. In this case, all the parts of the property will be treated as independent units, and only the income from the let-out units will be taxed as income from House Property. |

Under which section is income from house property taxed?

As per the Income Tax Act, income from house property is taxed under Section 22 of the Income Tax Act under the following conditions:

a) There should be a physical property that includes a building or the land attached to it.

b) The assessee should own the property.

c) The owner of the property should not use the property for the purpose of his own business or profession.

Is GST applicable on rental income?

Although rental income from residential properties are exempted from the Goods and Services Tax (GST) Act, income from renting out a commercial property will attract a 18 percent GST.

Read more about: GST on rental income: Applicable Tax Rates

How is income tax on rental income calculated?

Here’s how to calculate tax on rental income in India:

- Calculate the Gross Annual Value (GAV) of the rented property. This is defined as the annual rent received from the tenant.

- Subtract the amount of Property Tax paid from the Gross Annual Value to derive the Net Annual Value (NAV). Property Tax or House Tax is a municipal tax paid annually to the respective municipal authority.

- From the Net Annual Value (NAV), deduct 30 percent, which is the standard deduction permissible under Section 24A of the Income Tax Act.

- If the owner has taken out a housing loan for his/her rented property, the entire amount of interest paid on the housing loan during the financial year can be deducted from the rental income after allowing for the standard deductions. This rebate is permissible under Section 24B of the Income Tax Act.

- The remaining amount is the taxable rental income of an individual on which income tax shall be paid as per the corresponding tax slab.

Also Read: How to apply for a home loan process in India?

Rental tax calculation: Example

Let’s use an example to help clarify the calculation process further. In this case, the monthly rent of an apartment is Rs 25,000, the property tax to be paid is Rs 20,000, and the interest paid on the home loan is Rs 80,000. The table below breaks down the step-by-step rental income calculation.

| Parameters | Calculation |

|---|---|

| Monthly Rent | Rs 25,000 per month |

| Gross Annual Value (GAV) | 12 (months) x Rs 25,000 = Rs 3,00,000 annually |

| Property Tax | Rs 20,000 per year |

| Net Annual Value (NAV) | Rs 3,00,000- Rs 20,000 = Rs 2,80,000 annually |

| Standard Deduction | 30% of Rs 2,80,000 = Rs 84,000 |

| Interest Paid on Home Loan | Rs 80,000 |

| Total Taxable Income | Rs 2,80,000- Rs 84,000- Rs 80,000 = Rs 1,16,000 |

Note that if the GAV was less than Rs 2.5 lakh, there would have been zero tax on rental income.

Could the article help you understand the topic?

Could the article help you understand the topic?

Types of properties not covered under rental income calculation

Although almost every type of residential construction is covered under the computation of rental income, a few exceptions exist. The following property categories are prohibited from tax computation:

- A property inhabited by the owner for their own purpose under Section 23(2) of the Income Tax Act.

- Property with single ownership, wherein the house is not occupied for living, as the property owner is residing somewhere else owing to employability challenges.

- Properties adding up to the agricultural income, such as farmhouses under Income Tax Act Section 10(1).

- Property under the possession of a local authority.

- Property occupied by a registered trade union.

- A property belonging to a member of the Scheduled Caste/Tribe.

- A statutory association or an institution financially backed by the Government with an intent to promote members’ interests that belong to either Scheduled Tribes, Scheduled Castes or both.

- A Government-based corporation to promote the members pertaining to a minority group.

- Any cooperative society established keeping in mind the promotion of interests of the members that belong to any of the Scheduled Tribes or Scheduled Castes.

- Income generated by leasing a warehouse used to store, process and facilitate the promotion of commodities by an organisation set up under any law pertaining to the marketing of commodities under Section 22 of the Revenue Tax Act.

- Any institution associated with the set-up of ‘Khadi and Village Industries’.

- A housing property for any charitable activity within Section 11 of the Income Tax Act.

- A property belonging to any political party as per Section 13A of the Income Tax Act.

Also Read: What is the penalty on tax payment defaults?

Is rental income earned by NRIs taxable in India?

Rental income earned by NRIs is taxable under Section 24 of the Income Tax Act. However, in case of NRI-owned properties, the tenant makes the tax payment on behalf of the owner. Here's how the process goes-

After deducting the TDS (Tax Deducted at Source), the tenant makes the payment to the NRI's account. He/she then submits the TDS form to the respective authority and files Form 15CA with the Income Tax Department.

The NRI is liable to pay double tax, i.e., one in India as per Section 24 and the other in the country where he/she resides, for the same property. However, NRIs can avoid this double taxation by checking whether a Double Taxation Avoidance Agreement (DTAA) exists between India and the country where they reside.

How to save tax on rental income?

Here's a recap of the available deductions that can help homeowners save tax on rental income:

- Deductions through Gross Annual Value (GAV)- Apart from factoring in the rent received, any loss of rent due to vacancy or unrealised rent can also be adjusted from the actual rent receivable when calculating GAV.

- Standard deduction- Property owners can claim a 30 percent standard deduction on the NAV of the property under the painting and repairing provision, as per Section 24A of the Income Tax Act.

- Home loan interest deduction- If the property is rented out and the home loan repayments are underway, the owner can deduct the whole home loan interest component under Section 24B.

Also Read: Should you prepay your home loan or increase your EMI?

In a nutshell, homeowners planning to earn a secure and passive rental income must first understand the intricacies of the entire process. With a clear understanding of the rules and regulations, a property owner can significantly reduce their tax liability on rental income. However, consulting a local taxation professional for more case-specific knowledge on rental income and how to save taxes is always advisable.

See our latest webstory on All about taxation on rental income!

Generate Rent Receipt Online using 99acres for FREE!