While the completed properties are expected to remain unaffected by the implementation of Goods and Services Tax (GST), the price of under-construction properties may rise depending upon the rate of GST that will be finalised.

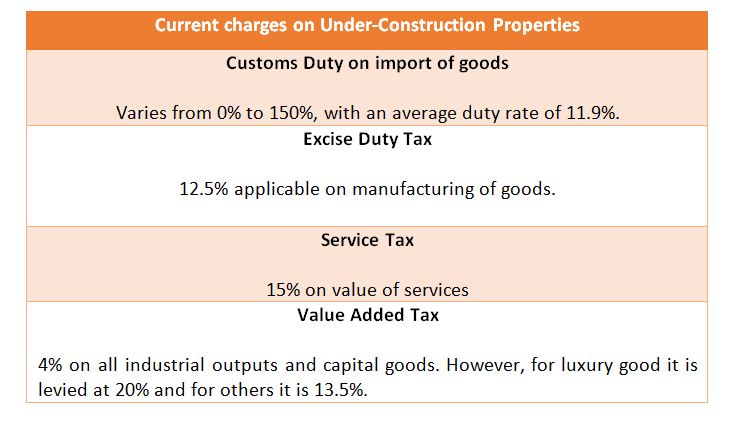

A real estate developer incurs various kinds of expenses during the construction of a project and pays non-creditable taxes such as entry tax, custom duty, service tax, VAT/CST, excise duty among others. These expenses are typically the part of overall cost pricing of the units. With the implementation of GST, all these non-creditable tax components have been unified, hence no major change is expected on this front. Price of completed properties will remain the same as GST does not cover immovable property sales. Buyers will have to pay stamp duty for such properties it will not subsume the stamp duty charges levied by the states as well.

However, the GST guidelines are silent on valuation of land and consider construction activities as ‘work contracts’ and will be taxed at the prevailing GST rate. Vineet Relia, Managing Director, SARE Homes, says, “For the developer, the aspect of valuation is a matter of concern as currently no deduction is provided under GST for value of land. This can add to higher tax burden considering there is already an additional tax incidence in the form of stamp duty on value of land.”

“The bill treats construction activities as “work contracts” but is silent about guidelines on valuation of land and has kept the sector away from input tax credit. This could mean higher costs for the end consumer. Also, implementation of the bill will not subsume the stamp duty levied by the states, which may increase it from time to time to meet revenue targets thereby pushing costs higher for the buyer,” says Neha Hiranandani, Director, House of Hiranandani.

GST will also be applicable on the materials that builders buy for the construction of properties. Amit Modi, Director, ABA Corp and Vice President CREDAI Western UP explain, “Much will depend on what rate of GST will finally be confirmed. If it is more than the current existing cumulative taxes, then it means that the overall cost of buying an under-construction flat will increase along with the added cost of stamp duty and registration.”