Industry reports highlight that real estate sales are about to increase by nearly 10-15 percent, closing in on almost 3,00,000 units in 2024 as real estate magnates continue their land acquisition spree at large. With the focus being on metropolitans, developers have been seeking out untapped markets nearby to capitalise on the growing residential demand. This has led to a considerable increase in land deals across prominent Indian cities. The article below traces the land-acquisition trend by builders in 2023 and 2024 so far, and the reasons behind the soaring housing demand.

Gurgaon land parcels peak in demand (Latest 2024 update)

The “Millennium city of India”, Gurgaon, is yet again making headlines as developers capitalise on land acquisition deals in the city. In recent news, the Haryana State Industrial and Infrastructure Development Corporation (HSIIDC) auctioned off four new land parcels to three developers, earning a profit of Rs 500 crore. Among these, Eldeco secured a 2.7-acre deal for Rs 110 crore in Gurgaon’s upcoming sector 80. This acquisition, backed by their previous purchase of an 8.5-acre land for Rs 165 crore in the same sector, proves sector 80 is going to be the next residential hotspot in Gurgaon.

Conscient developers also contributed to the land acquisition auction by purchasing a 5.56-acre parcel from HSIIDC for Rs 200 crore. Additionally, Trehan Iris acquired two land parcels from the auction, totaling their acquisition to Rs 190 crore for 5.08 acres. A representative from Knight Frank stated that the major land acquisitions happening in Gurgaon may pave the way for multiple residential developments.

Land acquisition spree among other real estate developers

Land ownership momentum and deals on direct acquisitions and joint ventures have gained steam among major developers across India. For instance, DLF Ltd has recently acquired a 29-acre land in Golf Course Extension, Gurgaon, against Rs 825 crore. The development potential of the land is expected to be 7.5 million sq ft. Simultaneously, TREVOC Group secured a 100-crore land deal along the Golf Course Road in Gurgaon.

Further, Lodha Developer, listed as Macrotech executed a 100 percent equity stake in Pune’s Goel Ganga Venture on January 25, 2024. On the commercial front, renowned developer Gulshan Homz acquired a 2.5-acre land for Rs 150 crore in Sector-129, Noida. Gulshan Homz is also developing a residential project in Moradabad in a joint venture with local partners in Uttar Pradesh. The project is expected to comprise 90 residential apartments.

Godrej Properties also contributed to the trend with their recent purchase of 4-acre land in Bangalore. Amid the intent to strengthen their foothold in the Bangalore realty, Godrej expects the development potential of the project to be around Rs 1,000 crore.

In the last fiscal year, Godrej has been in the spotlight for its rigorous land acquisitions, adding 18 new land parcels to its list. The revenue potential for these acquisitions are expected to be around Rs 32,000 crore, and the limit for 2024 has been set at Rs 15,000 crore.

However, this recent development by big developers has made land acquisition difficult for small-time local developers. For instance, the bidding norms for a 24-acre land parcel in Bandra, Mumbai, has not gone down well with developers as they are criticising its eligibility and financial criteria. According to developers, restricting the bidder’s net worth to enormous Rs 15,000 crore will limit a lot of small developers from being a part of this Bandra Reclamation Project.

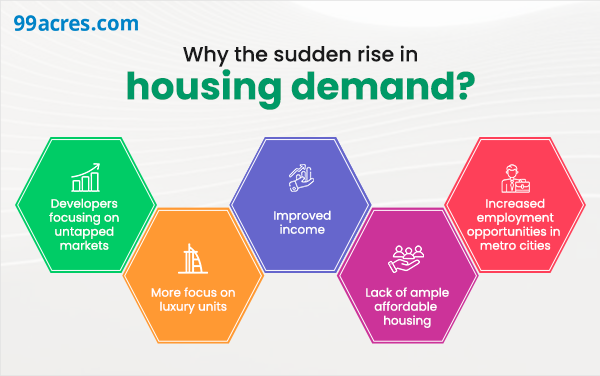

Reason for rising demand in housing

The Confederation of Real Estate Developers’ Associations of India (CREDAI) estimated that housing demand is expected to touch 93 million by 2036, cementing the fact that the trend of rising residential sales is here to stay. But what could be the driving factor for such unwavering demand despite rising living costs?

Shishir Baijal, Chairman and Managing Director, Knight Frank India says, “An increased interest cost environment stemming from heightened inflation levels, the robust domestic economic fundamentals, and the escalating aspirational attributes of residential real estate have been driving the demand among homebuyers. However, the trend is prominent in major residential markets within the country.”

Could the article help you understand the topic?

Could the article help you understand the topic?

Major land acquisition activities in the past year

While Q1 of 2024 started off strong on the land acquisition part, the preceding year saw some remarkable deals. Below are some notable land-buying deals recorded in 2023:

- BPTP Developers acquired a 5.2-acre land parcel in Gurgaon, near Dwarka Expressway for Rs 87 crore

- Chintels India transferred land parcels near Dwarka Expressway worth Rs 121.82 crore to Sobha Group

- TATA Realty bought a 1.02 lakh sq m land from Graphite India in Bangalore, worth Rs 986 crore

- Casa Grande secured a four lakh sq ft deal in Hyderabad for Rs 56.8 crore

- Oberoi Realty entered the Delhi NCR realty market with a land deal in Gurgaon for Rs 597 crore

- Birla Estates acquired a 28-acre land in Bangalore’s Sarjapur for a residential project

- HSIIDC granted auction-winners Ashiana Housing 43,708 sq m of land for residential development in sector 80, Gurgaon.

- Adore Group also invested Rs 200 crore on a 10.20-acre land in sector 77, Gurgaon, and potential homebuyers can now expect a one-of-a-kind residential project in the making, based on the Greek lifestyle theme.

Land investment trends to watch out for

Given the current scenario, industry experts have identified a few prevailing investment trends that can help both developers and investors make a better judgment call for the coming fiscal years. For instance, the focus on Tier-1 cities is still prevalent as major builders are buying land parcels for development in and around these areas.

However, Tier-2 and Tier-3 cities, too, hold incredible investment potential. According to recent news, builder brands are eyeing the untapped markets of Panipat, Ludhiana, and Nagpur. The MMR (Mumbai Metropolitan Region) is also one of the top preferences for investors. Customers are keen to buy new properties in their early stages as they involve lower cost and have high scope for appreciation.

Taking cognisance of the above trends, the surge in housing demand is here to stay for a while and developers plan to strike the iron while it is still hot. Overall, industry experts anticipate the land acquisition trend to stay strong in 2024, with Tier-1 cities and emerging pockets remaining the hotbeds.