Property circle rates in Kolkata are revised periodically to match the contemporary market rates and to calculate the minimum value of properties. Also called ready reckoner rates, the circle rates are calculated in Rs/sq m, and act as a benchmark for the valuation of properties to determine the registration charges and stamp duties in Kolkata levied on new property transactions.

List of circle rates in Kolkata

Here is the list of circle rates in Kolkata levied by the state government:

| Localities in Kolkata | Average circle rate (per sq m) |

|---|---|

| Agarpara | Rs 2,626 |

| Action Area III | Rs 4,524 |

| Alipore | Rs 12,689 |

| Action Area I | Rs 4,882 |

| Airport Area | Rs 3,062 |

| Action Area II | Rs 4,858 |

| Ashok Nagar | Rs 4,690 |

| Bablatala | Rs 3,264 |

| Andul Road | Rs 3,148 |

| Baguaiti | Rs 2,995 |

| Baguiati | Rs 3,257 |

| Baghajatin | Rs 3,858 |

| Ballygunge | Rs 9,983 |

| Ballygunge Circular Road | Rs 13,492 |

| Baishnabghata Patuli Township | Rs 4,786 |

| Ballygunge Place | Rs 11,322 |

| Bangur Avenue | Rs 4,881 |

| Ballygunge Park | Rs 10,051 |

| Bangur | Rs 4,823 |

| Barasat – Madhyamgram | Rs 2,773 |

| Baranagar | Rs 3,363 |

| Baruipur | Rs 2,281 |

| Beleghata | Rs 5,678 |

| Behala | Rs 3,644 |

| Belghoria | Rs 3,133 |

| Bhawanipur | Rs 9,096 |

| Bally | Rs 2,769 |

| Barasat | Rs 2,276 |

| Bansdroni | Rs 3,584 |

| Barrackpore | Rs 2,534 |

| Behala Chowrasta | Rs 3,475 |

| Bata Nagar | Rs 3,733 |

| Belgharia Expressway | Rs 3,733 |

| Birati | Rs 3,264 |

| Beliaghata | Rs 5,151 |

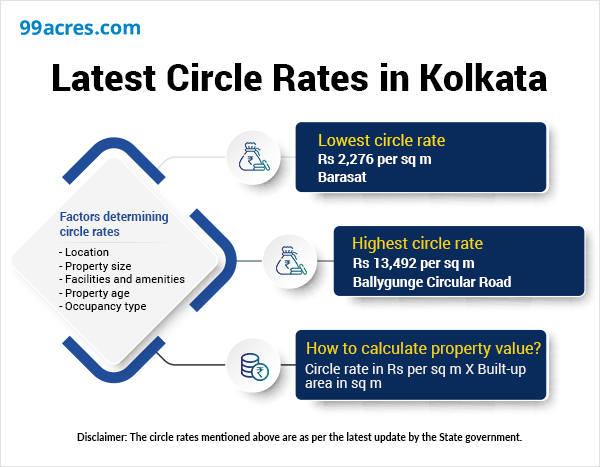

What are the determining factors of circle rates in Kolkata?

The circle rate of a locality is determined by the following factors:

- Location

- Size or area of the property

- Facilities and amenities available with the property

- Age of the property

- Commercial or residential (occupancy)

- Type of property (flat, apartment, independent house, plot)

How to calculate property value using circle rates?

The formula for the calculation of the value of a property in Kolkata is:

Value of a property = Circle rate in Rs/sq m X built-up area in sq m

If the circle rate of a locality is Rs 3,000/sq m and the area of the property is 100 sq m, then its current value will be:

Property value = Rs (3,000 x 100) = Rs 3,00,000

This is how the value of a property is calculated and matched with the current market value. If the market value is higher than the circle rate value, the former is used to determine the stamp duty and registration charges will be paid by the new owner.